AI Power Surges While Quantum Computing Gains Institutional Traction

Defiance ETFs: Weekly Market Update | September 8, 2025

Hi everyone,

This week delivered strong momentum for both AI powerhouses and quantum computing innovators, reinforcing my thesis that we're witnessing two parallel technology revolutions driving transformational investment opportunities. The numbers are staggering - and the strategic positioning is becoming clearer.

For investors looking to participate in these technology themes, the convergence of massive corporate AI spending commitments and emerging quantum commercialization creates compelling opportunities in both established leaders and next-generation disruptors.

AI Giants Double Down on Infrastructure

Alphabet (GOOGL) enjoyed an impressive 8% surge this week following a favorable federal court decision that preserved its lucrative search agreement with Apple, significantly easing antitrust pressure. The ruling allows Google to continue making payments to device makers to preload its services, though it cannot maintain exclusive distribution deals. This outcome was far better than the worst-case scenario that could have forced Chrome's divestiture.

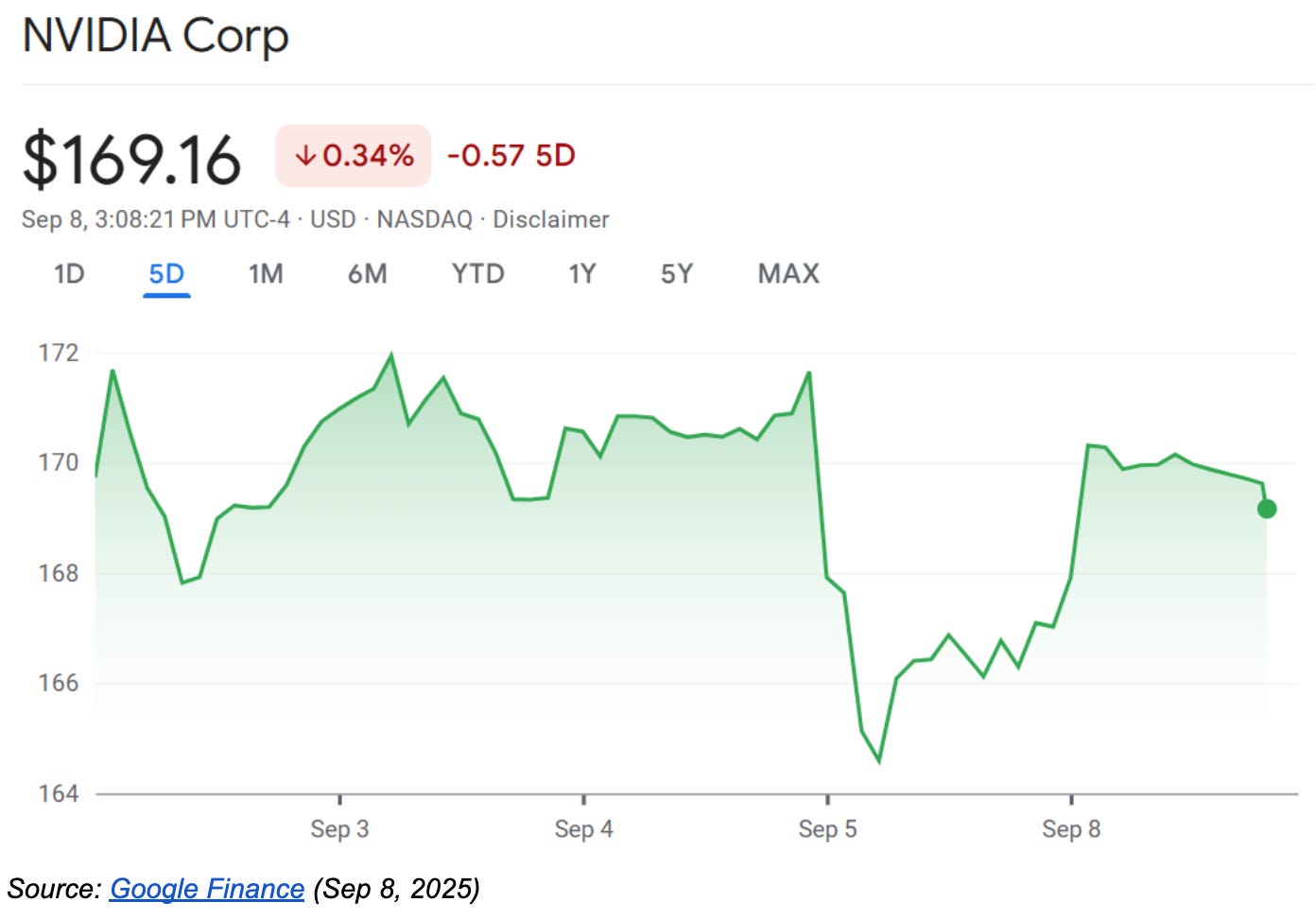

Nvidia (NVDA) rebounded strongly after delivering solid Q2 earnings with $1.05 EPS on $46.74 billion revenue, slightly beating expectations. The standout move was announcing a massive $60 billion stock buyback authorization - one of the largest in corporate history. This represents serious confidence from management, especially when you consider Nvidia already returned $24.3 billion to shareholders in the first half of fiscal 2026.

What's particularly compelling is the competitive landscape shifting around Nvidia. Broadcom shares soared 9% on news of securing a $10 billion order from what analysts widely believe is OpenAI for custom AI accelerators. This partnership aims to help OpenAI reduce its dependence on traditional GPU suppliers while addressing the hardware shortages that have slowed AI deployment.

Meta revealed the most ambitious AI commitment yet, with CEO Mark Zuckerberg announcing plans to invest "at least $600 billion" in U.S. data centers and infrastructure through 2028. This enormous capital commitment underscores the AI arms race intensity and creates massive opportunities for infrastructure providers including Nvidia, Broadcom, and data center operators.

Looking at the broader picture, Nvidia CEO Jensen Huang projects $3-4 trillion in AI infrastructure spending by the end of the decade, calling it "a new industrial revolution". These aren't theoretical numbers - they're backed by concrete corporate commitments and the fundamental need to build computing capacity for next-generation AI applications.

Quantum Computing Attracts Serious Capital

The quantum space is gaining institutional credibility with real commercial applications. In Decemeber of 2024, Quantum Computing Inc. (QUBT) secured a prime contract from NASA's Goddard Space Flight Center to apply its Dirac-3 quantum optimization machine for interferometric data processing. The company also landed a $406,478 NASA subcontract this year to develop quantum solutions for removing sunlight noise from space LIDAR data.

These aren't research grants - they're paying contracts for solving real operational problems. NASA's validation lends significant credibility to the near-term commercial viability of quantum computing.

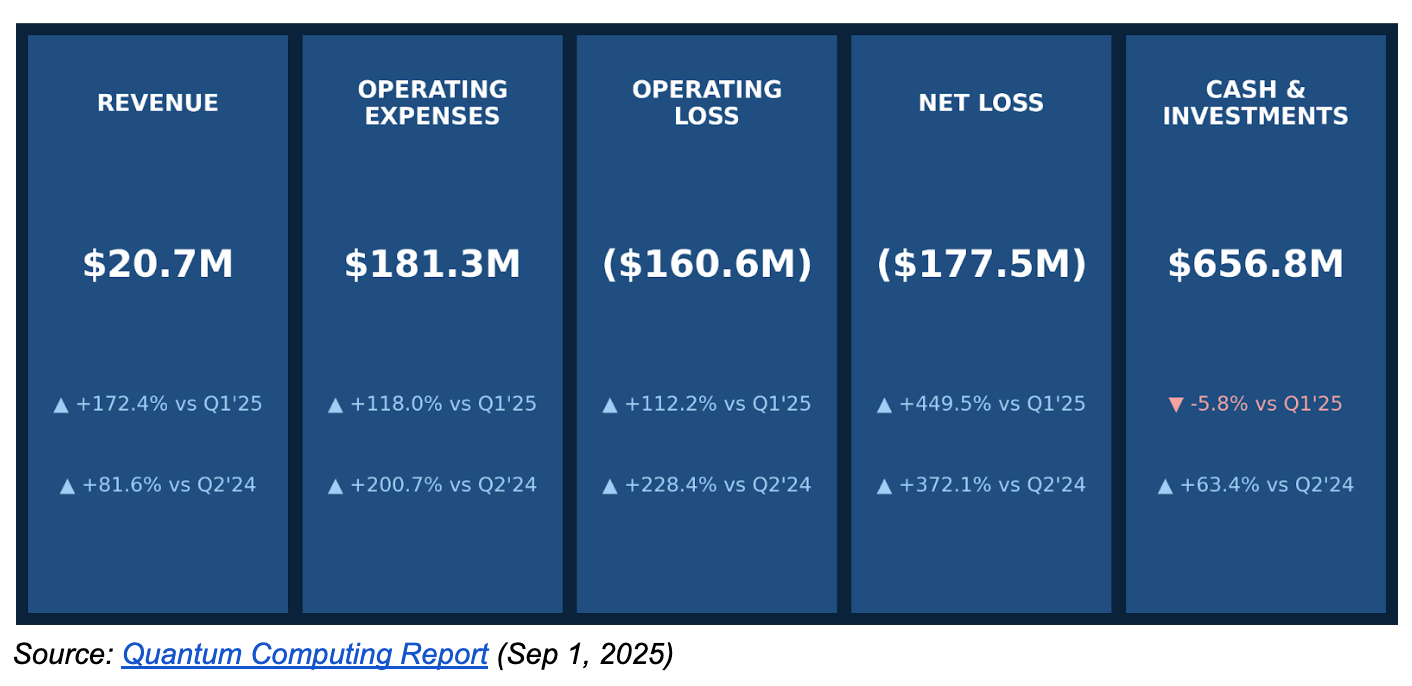

Analysts project IonQ's revenue will surge from $43 million in 2024 to $315 million by 2027, driven by broader commercial adoption of its trapped-ion quantum systems. The company's Q2 2025 results show this acceleration happening now - revenue jumped 172% quarter-over-quarter to $20.7 million, driven by commercial traction, including a $22 million deal with EPB. That's not just steady growth; it's the kind of hockey stick revenue pattern that signals real market adoption.

Yes, operating expenses rose significantly as IonQ scales its technology and manufacturing capabilities, but the company maintains $656.8 million in cash and investments - providing substantial runway to fund this commercialization push. For growth-stage quantum companies, this spending pattern reflects the transition from R&D to revenue generation.

D-Wave (QBTS) continues positioning as the other major "pure play" quantum stock with its distinctive annealing-based approach, offering diversification within the quantum computing landscape. Both companies represent different technological paths toward quantum advantage, creating investment opportunities across multiple quantum computing architectures.

The Investment Framework

Here's what I'm seeing: AI infrastructure spending is accelerating beyond most expectations, while quantum computing is transitioning from research to revenue-generating applications. The scale of projected AI infrastructure investment—$3-4 trillion by 2030—creates enormous opportunities for companies building the compute backbone of the AI economy.

For investors seeking exposure to quantum computing's commercial emergence, the combination of government validation through NASA contracts and growing institutional investment signals that the sector is moving beyond speculation toward practical applications. Meanwhile, the AI infrastructure build-out offers opportunities in both established leaders and emerging challengers.

The key insight: we're not just witnessing incremental technology improvements. These are foundational shifts that will require massive capital deployment and create winner-take-all dynamics in critical technology sectors. The companies building tomorrow's computing infrastructure today are positioning for decades of growth as digital transformation accelerates across every industry.

Best regards,

Sylvia Jablonski

CEO & CIO

Follow us on X (Twitter) | LinkedIn